The Driverless Revolution: Navigating the Changing Landscape of Auto Insurance

As the world witnesses the gradual but certain emergence of autonomous or driverless vehicles, it’s not just the roads that are changing; it’s the very nature of risk and insurance that’s undergoing a massive transformation. The advent of driverless cars is set to revolutionize the insurance industry, challenging traditional models and redefining the concept of risk. In this article, as part of our domain series, we’ll explore how the rise of autonomous vehicles is reshaping the insurance landscape and invite you, our readers, to share your insights and predictions on the evolving future of auto insurance.

The Impact of Driverless Cars on Insurance

1. Fewer Accidents, Fewer Premiums?

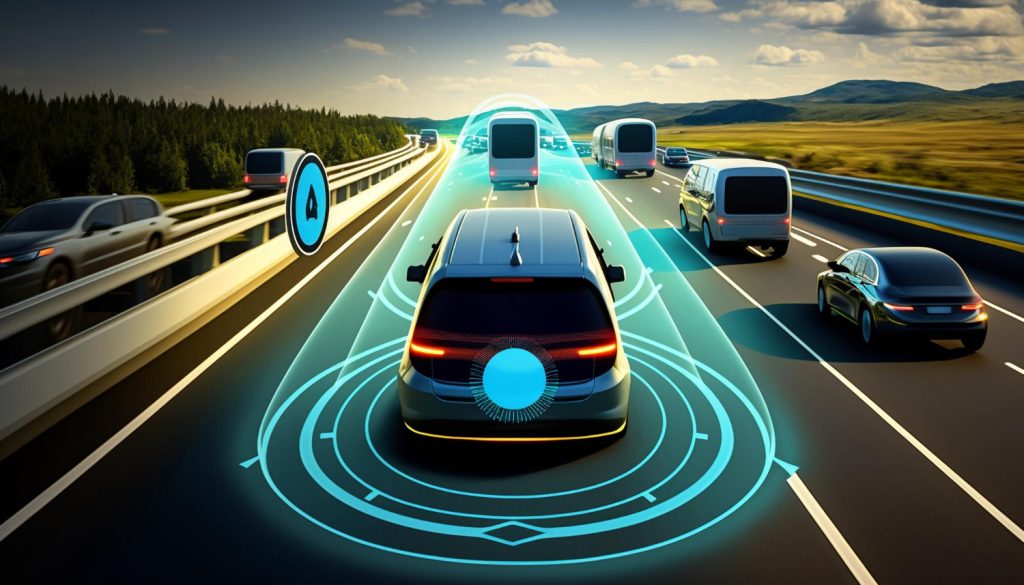

One of the most significant shifts with autonomous vehicles is the potential for a dramatic reduction in accidents caused by human error. Human factors, such as distraction, fatigue, and impaired judgment, are responsible for a large portion of accidents on the road today. Driverless cars, equipped with advanced sensors and AI systems, promise to minimize these errors. As a result, the number of accidents could decrease substantially.

This raises a compelling question: If accidents become rarer, will the traditional model of auto insurance, which charges premiums based on perceived risk, still be relevant? Insurers may need to reevaluate their pricing structures as the risk landscape evolves.

2. Shifting Liability

With driverless cars, the locus of liability is expected to shift from individual drivers to vehicle manufacturers and technology providers. In the case of an accident caused by a malfunctioning autonomous system, determining responsibility may involve complex legal battles. Insurers will need to adapt to this changing landscape by developing policies that account for new liability scenarios.

3. Data Is King

Autonomous vehicles generate an unprecedented amount of data. This data can include information on driving behavior, vehicle diagnostics, and real-time road conditions. Insurers are likely to increasingly rely on this data to assess risk accurately. Telematics, which involve tracking and transmitting data from vehicles, may become a standard practice in finance banking insurance, offering policyholders customized pricing based on their driving habits.

The Need for Adaptation and Innovation

As the auto insurance industry faces these seismic shifts, there’s an undeniable need for adaptation and innovation. The traditional ways of underwriting, pricing, and assessing risk may no longer suffice. Here are some areas where the finance banking insurance industry can focus its efforts:

1. Product Innovation

Finance Banking Insurance providers can explore new product offerings tailored to the needs of autonomous vehicle owners. These products might encompass coverage for technology malfunctions, cyber threats, and liability disputes involving software providers.

2. Data Analytics

Investing in robust data analytics capabilities will be essential. Insurers can leverage the wealth of data generated by autonomous vehicles to refine their risk assessment models and provide more accurate pricing.

3. Collaboration

Collaboration between the automotive industry, technology companies, and insurers will be crucial. Insurers can work closely with vehicle manufacturers to develop comprehensive risk-sharing models and define liability in autonomous vehicle accidents.

Share Your Insights

The future of auto insurance may be at a crossroads, and the industry needs your insights and predictions. Vinz Global invite you to share your thoughts on the changes the insurance sector should embrace to effectively navigate the driverless revolution. How do you envision the role of insurance evolving in a world where accidents are rarer, but liability scenarios are more complex?

Voice your opinions, concerns, and innovative ideas in the comments section below. Together, let’s shape the future of auto insurance in the era of autonomous vehicles.